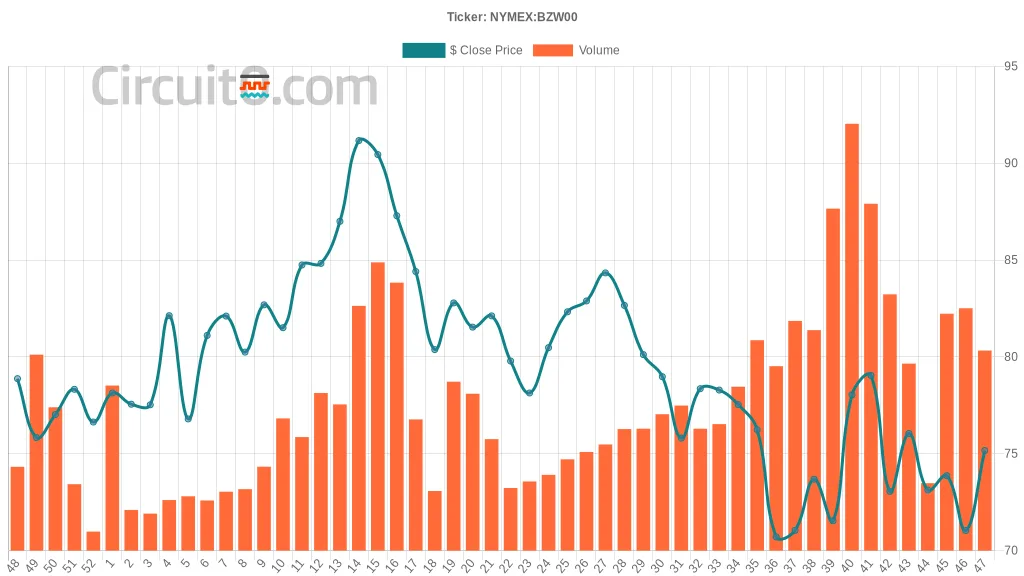

Brent crude oil recently closed at 75.17 per barrel, reflecting a slight uptick compared to last week’s close of 71.04. This increase is noteworthy considering the ongoing geopolitical tensions, particularly with Israel and Iran, which have been influencing market sentiment. The tensions stem from the discussions around military responses and the potential for oil supply disruptions if conflict escalates.

If we look back, in mid-November, Brent was sitting at about 73.87, indicating a steady rise in price despite lingering uncertainties. Prior to that, the prices dropped as low as 70.88 towards the end of the last week, suggesting a heightened volatility in the market as traders react to current events.

Overall, the recent trends show that prices have seen some recovery this past week, bouncing back from previous low points earlier in the month. In a broader historical context, prices have noticeably fluctuated over the past year, where Brent crude has ranged from highs around 91.91 in early April to dramatic lows, such as the found under 75 recently. With the current developments still unfolding overseas, it will be critical for traders to keep an eye on not just the price movements but the events shaping those movements.