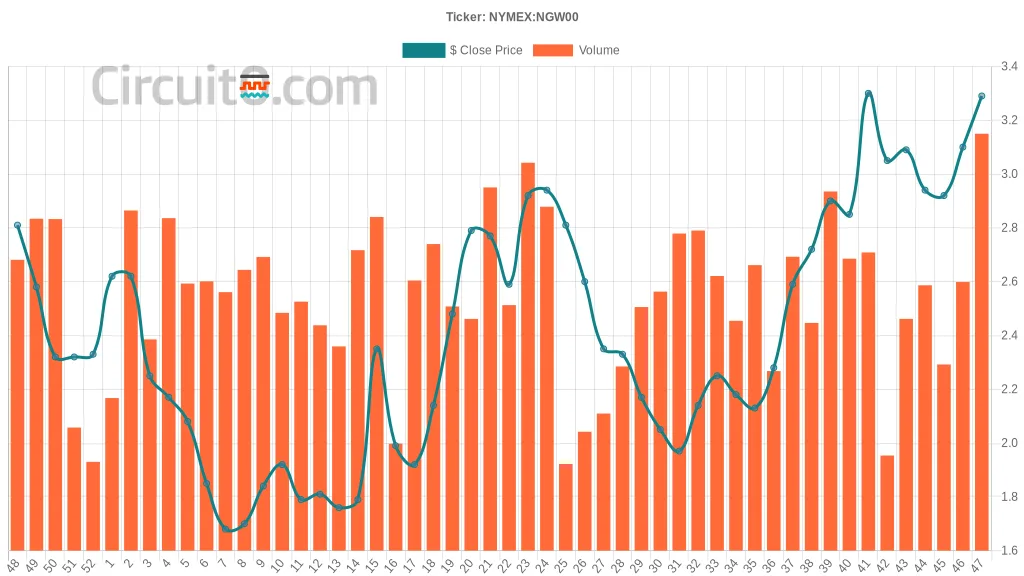

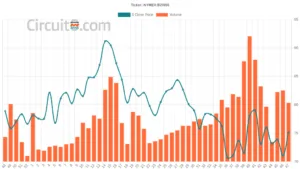

Natural gas prices have seen notable fluctuations recently, closing last Friday at $3.29 after experiencing a range from a low of $3.09 to a high of $3.64 during the week. This represents a healthy upward movement compared to previous weeks, where the close was around $3.1, indicating a steady rebound.

The market sentiment is shifting, especially in light of the recent report from the EIA that projects a decline in U.S. natural gas production for 2024 alongside a surge in demand. Such dynamics have historically impacted prices, typically driving them up when production concerns arise alongside increasing consumption needs.

In the weeks leading up to the last close, prices were gradually increasing from the $2.85 mark earlier this month to the current $3.29. The upward trend reflects a recovering market sentiment, buoyed by the expectation of robust demand despite concerns regarding supply constraints. This trend follows the broader historical context where periods of tightening supply have often led to upward price movements, especially as consumption patterns shift seasonally.

Overall, the recent upswing in natural gas prices paired with anticipated production declines suggests a market gearing for potential volatility, reflecting both consumers’ growing needs and the complexities of U.S. supply.