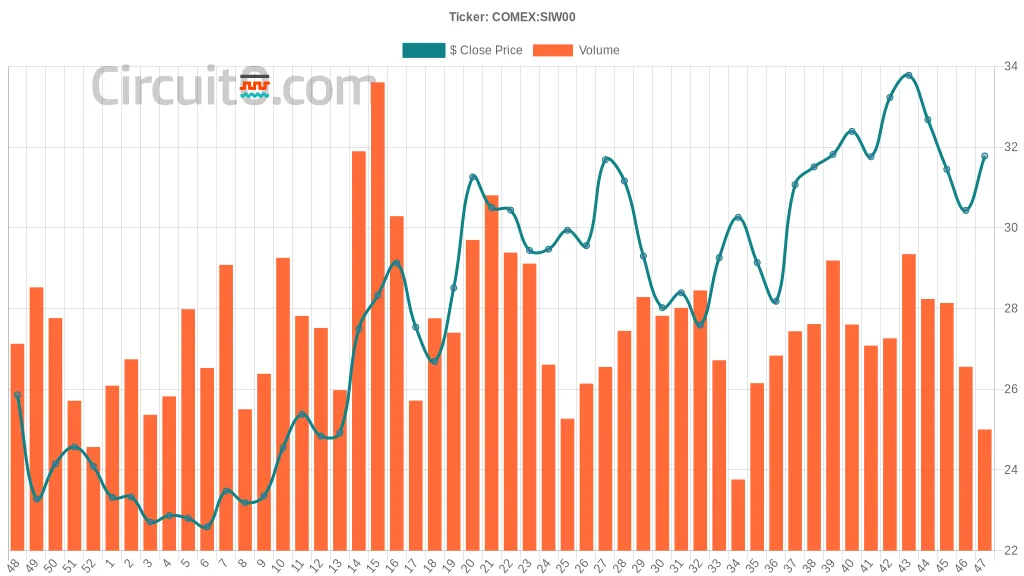

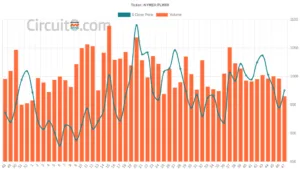

Silver has shown quite the up and down journey recently. Just last Friday, the price closed at about $31.78, a bounce back from the previous week when it dipped to around $30.43. This is quite notable as prices had been near the highs earlier this month, reaching as high as $33.78 just a week before.

As we trace back over the last few weeks, silver went through a noticeable fluctuation pattern. In mid-November, it had dropped after climbing significantly during October, with highs around $33.23 by November 1st. It seems there’s been a bit of a correction happening after such spikes. The price was pretty steady between low thirties and high twenties throughout September and October, peaking after that initial climb toward the end of October.

Comparing the trend to earlier in the year, prices were sitting much lower just a few months back, around the mid to low twenties for most of January. The upward momentum throughout the latter part of the year certainly highlights the volatility in the market. Overall, silver is still hovering above $30, which is a significant position compared to the fluctuations earlier in the year, but traders will be watching closely to see how this correction plays out going forward.