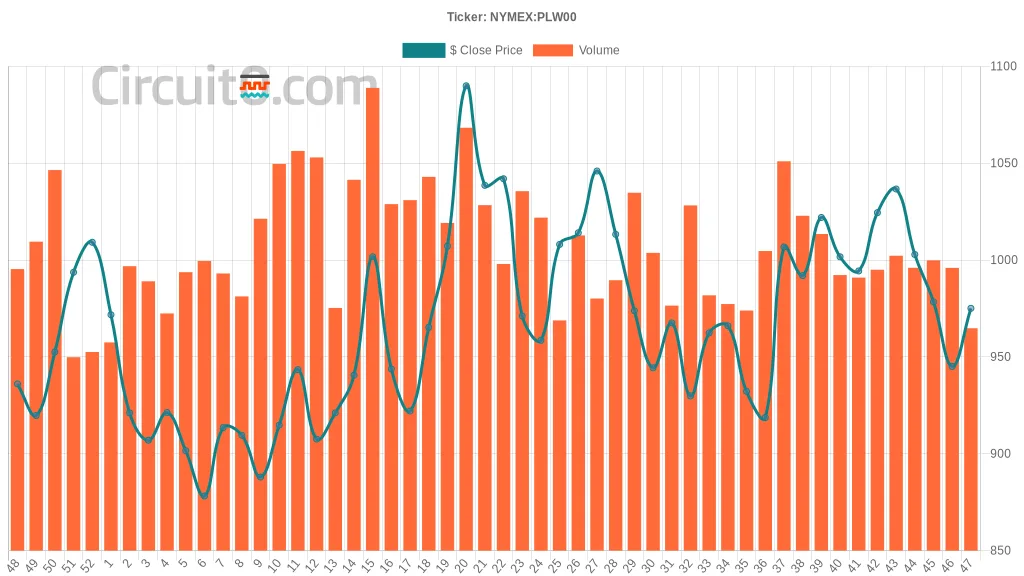

Platinum prices lined up with recent trends, experiencing fluctuations over the previous weeks. Last week, the price opened at 973.2 and closed slightly lower at 975.1, reflecting a stable but slightly bearish sentiment in the market. This follows a notable decline from a recent peak of 1036.7 on October 25, right before the current downtrend.

Looking back over the last few months, platinum began the fourth quarter on a high note, buoyed by market momentum that saw it consistently surpass the $1,000 mark through late October. After hitting that recent high, there was a pullback as prices dropped, largely influenced by broader market dynamics and commodities fluctuations. Interest waned a bit, with lower volumes recorded leading into last week’s close.

Comparing this week’s pricing to earlier trends, it highlights how the market has transitioned from a robust rally earlier in the year, where prices ventured close to $1,100 in May, to the current trading range. This gestured a market in search of direction after the substantial price movement observed in the last quarter and raised questions about ongoing demand amid external economic pressures. As traders and investors navigate these conditions, the focus remains on understanding short-term movements while keeping an eye on longer-term trends influenced by both demand in industries that rely on platinum and global economic conditions.